In numerous states, you should be 18 prior to you can own a cars and truck without an adult's name on the vehicle registration. A. Automobile insurance coverage policies normally last six months. You will get a notification when it's time to renew your insurance coverage.

A. Under most situations, somebody using your cars and truck with your consent is covered by your insurance. If the person borrows your automobile with your permission and is associated with an accident, your insurance will pay simply as if you were the chauffeur. In some states, some insurers might restrict the coverage.

In this example, a young driver might see the rate of their insurance coverage more than double after one ticket and one mishap. Just to highlight, the company used much better than typical coverage for our rate examples, not barebones protection, so they are not the company's lowest costs. All are based on the teen driving a 2003 Honda, normal usage.

The Facts About Helping Cut Costs For Teen And New Drivers - Geico Uncovered

If you have an older automobile with low market worth, it might be an excellent idea to reduce your premium by removing accident coverage. When you lend your car to someone and they cause an accident, it is their automobile insurance coverage that will cover the damages on your vehicle.

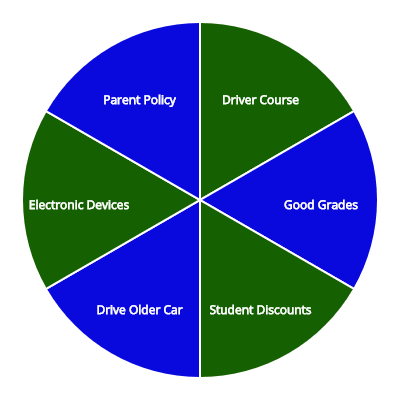

Discount rates aren't the only way to minimize your teen's cars and truck insurance. Here are some other ideas to help lower your expense. Buy an older car The expense of an automobile helps figure out the cost of your insurance, so get your teen an older, more economical automobile. Older vehicles that are paid completely offer you the option to drop crash and detailed insurance and carry just liability defense.

It likewise comes from your vehicle insurance premium increase when you add a teen motorist to your policy. Find out about including a teen chauffeur to your policy and some business that use discounts on auto insurance.

The Best Guide To Student Driver Guide - Advice: Stay On Your Parents' Policy

Some vehicle insurance coverage offers some safe driving discounts to teenagers who complete a teen driving course. You may even discover companies that utilize both driving courses and good grades as discount rates.

You might likewise have the ability to integrate other insurance policies or bundle your insurance to reduce your expenses. Examine with your insurance agent to discover if there are other strategies you can utilize to reduce your insurance coverage premiums. You might consider searching for another service provider. You might be able to discover better prices with another business for your entire family.

You need to consider the protection you are getting, the cost you spend for it, and the insurance business's credibility. Companies That Offer Teen Safe Driving Discounts Here are some of the numerous safe driving programs and discounts from leading auto insurers. AAA Insurance AAA Insurance has a teen safe driver plan that could conserve you some cash.

Car Insurance For Teenage Drivers - Edmunds - Questions

It keeps an eye on difficult braking, velocity, night driving, and distance. If it's in the cars and truck your teen drives and they drive securely, you might see a discount rate of up to 40%.

Bundling your insurance with one provider is a fantastic way to reduce your insurance coverage costs, even with a teen chauffeur. State Farm State Farm has numerous choices that can assist reduce the bill after including a teenager driver.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/african-american-teen-learning-to-drive-with-mom-123133825-580f95893df78c2c73b8c4ac.jpg)

If your university student is at school, and the cars and truck is only utilized while they are home throughout breaks, a discount is used until they are 25 years of ages. In its "Avoid" program, State Farm has 5 training modules. The modules have lessons, videos, and some quizzes. Your teen is then asked to drive at least 10 trips with a mentor that totals 5 hours of driving time.

All about Average Cost Of Car Insurance For 16-year-olds - Valuepenguin

As soon as the program is complete, your teen gets a certificate that you can send out to your agent for a discount. State Farm also states you might be able to minimize your insurance bill by ensuring the cars and truck your teen drives has the most current security options and is a less costly model.

For parents, the excitement of having a novice driver in the house is normally tempered with concern. With little driving experience, immature chauffeurs are at a higher risk for mishaps. Obviously, safety concern is uppermost in most moms and dads' minds but other stressorslike the high expense of guaranteeing your brand-new chauffeur and the monetary liability implications of a teenager driving mishapcan be minimized with these actions.

Encourage positive behaviors Car insurers use discount rates or reduced premiums to: Students who maintain at least a "B" average in school Teens who take a recognized driver training course College trainees who attend school at least 100 miles away from home and do not bring their automobile to school Pick the ideal auto insurance business It's normally less expensive for moms and dads to add teenagers to their automobile insurance coverage policy than it is for teens to buy one on their own.